From 1 April 2017, tax must be deducted from all payments made to contractors working under a ‘labour hire arrangement’ for a labour hire business. This change will impact many businesses and different industries such as: employment agencies, ‘temp’ agencies, on-hire businesses as well as the wider recruitment, IT and healthcare industries.

From 1 April 2017, it will be the business’s obligation to withhold a portion of the payment made to the contractor, and return this to the Tax Department.

What is a labour hire business?

A labour hire business “has one of its main activities the business of arranging for a person to perform work or services directly for clients of the entity”.

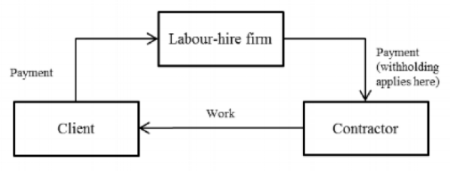

Simply put, if your business arranges for contractors to work directly for another business, and your business receives payment from the other business and then pays the contractor, then this is a labour hire business.

What is a labour hire arrangement?

A labour hire arrangement is when a person is paid by a labour hire business to perform work or services directly for the client of the business or other person, instead of performing work or services for the business itself.

A key differentiation is where the contractor provided to the client works under the general direction of the client (as an extension of the client’s team) – this is a labour-hire arrangement. Where the skilled worker delivers an agreed result or outcome for the client (for instance a phase of a project) as directed by your business – this is not a labour-hire arrangement.

The rules still apply if the contractor is a natural person or a business.

Does this apply to your business?

If you are a labour hire business and in a labour hire arrangement, then you will need to comply with the rules unless your labour hire activities are not your main business i.e. you have other business activities and labour hire is only a small part of the overall activities.

What are your responsibilities?

When making payments to the contractor, you will need to withhold tax on the payment. The percentage of tax you need to withhold will depend on the contractor and can range between 33 percent to 0 percent.

You need to include the payments in the form normally used for PAYE payments – the employer monthly schedule. How often you need to file will depend on the size of your business. The payments are due by the Tax Department the same time PAYE payments are due.

Another rule change applying form 1 April 2017, is contractors will be able to choose the percentage of withholding tax to be deducted from their payments.

Special rate certificates

If the rules apply to your situation, it is possible to withhold zero tax on the payments to the contractors, if the contractor holds a special rate certificate. The contractor will need to apply to the Tax Department to obtain a special rate certificate. The contractors can then present special rate certificate to your business and enable you to withhold tax at 0 percent, reducing the compliance cost for your business.

We can answer your questions on the new labour hire withholding rules, if the rules apply to your business, as well as how to comply with them.